India’s digital public infrastructure and the G20

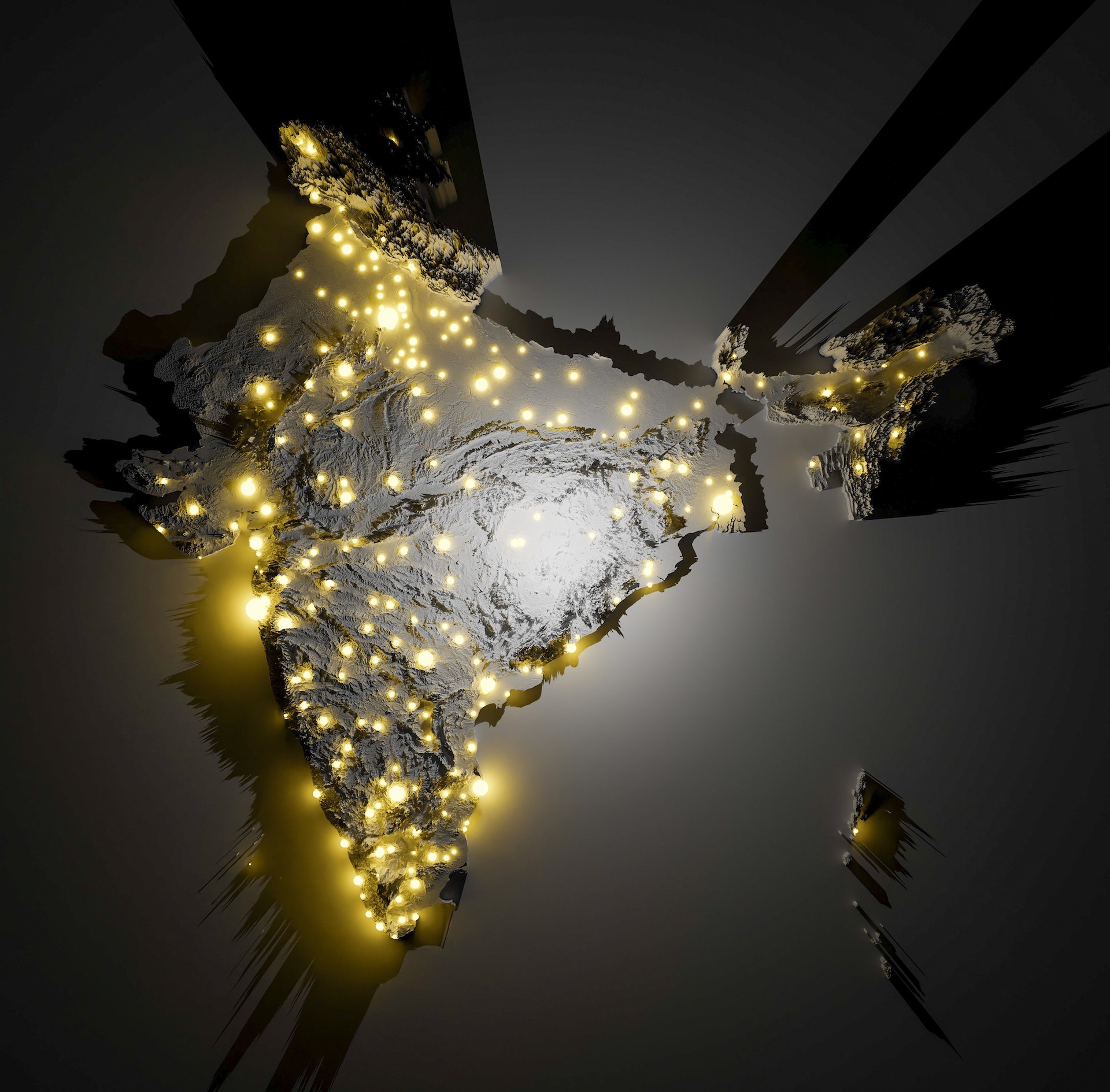

India has experienced rapid leaps forward in its digital public infrastructure, but there is plenty of room for expansion – and plenty of scope for profound impacts

Digital public infrastructure enables many socio-economic activities including development. Advances in information technology, internet connectivity and the wide availability of devices such as smartphones and tablets have contributed to this evolution. India has been in the forefront, with a rapid expansion of its DPI. This has ushered in a veritable socio-economic transformation, strengthening the participation of citizens in economic activities.

Basic DPI mediates the flow of people, money and information. It includes a digital identification system, a real-time fast payment system and a consent-based data sharing system. India developed India Stack, with the three foundational DPIs: Aadhaar, which is a digital identity; the United Payments Interface; and a platform to share personal data safely without compromising privacy (an account aggregator built on the Data Empowerment Protection Architecture). Each layer fills a clear need and generates considerable value across sectors.

Aadhaar has more than 1.31 billion users (95% of India’s population), who can perform several actions including remote authentication of personal data. Using DigiLocker, a public utility, Aadhaar users can keep digitally signed, legally valid electronic documents. Currently more than 4.6 billion documents are issued directly into DigiLocker, with 1,460 institutions signed up as document issuers.

Homegrown systems

UPI is India’s homegrown real-time mobile payments system. It has led to financial inclusion, providing every citizen with a bank account, so they can participate in the digital economy so rapidly enabled by smartphones. UPI is interoperable between money custodians, payment platforms and front-end payment applications. It is operated by the National Payments Corporation of India and has three tiers. At the base are the public rails provided by NPCI, which handles the routing of payments messages. Over this lies the second tier, consisting of regulated banks, responsible for holding user funds and updating account balances. The third tier is the fintech layer, through which payment apps and fintechs can gain access to the system underneath. By June 2023, 458 of India’s top banks were connected to the UPI system, with 9.3 billion transactions per month at a value of INR 14.8 trillion.

UPI has rapidly gained ground in India’s payment ecosystem due to the superiority of the end user experience. Users can make real-time payments directly using their bank accounts, at essentially no cost. Autopay was launched in 2020 to enable event-based triggers for recurring payments such as rental payments or subscription services. More recently, NPCI announced a new digital payment mode called e-RUPI, which functions as an electronic voucher system available to any mobile phone user in India. Linkages with payment systems in other countries such as Singapore and the United Arab Emirates are being explored.

The Data Empowerment and Protection Architecture, the data layer of India Stack, aims to restore the ownership and control over user data to its rightful owners. At its core are three main pillars: the landmark Personal Data Protection Bill, an electronic consent artefact for capturing user consent to share personal data with third parties and regulated entities known as consent managers or account aggregators. These provide an interface to facilitate data sharing and consumption with user consent. The system would enable consent-based data sharing across sectors such as health care and e-commerce so consumers can avail themselves of relevant products and services including loans, telemedicine, portfolio management and a host of other uses still to be developed. As of July 2023, 11.9 million accounts are linked to the system.

During the Covid-19 pandemic, India introduced CoWIN, an electronic system for vaccination management. It gained wide acceptance and became a powerful tool for facilitating access to vaccination centres and generating vaccination certificates. CoWIN has 1.1 billion registered users, and tracked 2.2 billion doses of vaccines across 117 centres.

Digital progress

At the third meeting of the G20 Digital Economy Working Group in Pune in June 2023, India signed memoranda of understanding with Armenia, Sierra Leone, Suriname, and Antigua and Barbuda on sharing India Stack. The next steps are the working group’s fourth meeting and the meeting of G20 digital economy ministers in August in Bengaluru. These mechanisms could help address some challenges and drive improvements in DPI globally. Much of India’s experience is replicable in other countries. India has offered to share its experience, especially with the Global South. There is a rich scope for the G20 to strengthen cooperation in DPI.

New capabilities

New and innovative additions to India’s DPI will undoubtedly emerge and add new features and capabilities. Integrating DPI with government services and other service providers would offer many benefits, especially the efficient direct transfer of benefits. The impacts on micro, small and medium-sized enterprises and on informal sector players could be profound. Of course, challenges remain. Connectivity, especially in a country the size of India, may need improvement. Security is always a concern, given cyber crime and terrorism. Digital literacy, access and inclusion, especially for poor sections of the population, must be expanded. In addition, there are issues regarding the role of big tech in the area of digital infrastructure, where there could be large profits to be made.